This comprehensive guide provides essential resources for aspiring claims adjusters, covering key concepts, insurance terms, and practical skills to excel in the profession effectively.

1.1 Overview of the Claims Adjuster Profession

A claims adjuster plays a critical role in the insurance industry, evaluating and settling insurance claims efficiently. They investigate incidents, assess damages, and determine the validity of claims. Adjusters must possess strong analytical, communication, and negotiation skills to ensure fair resolutions. The profession requires a deep understanding of insurance policies, legal frameworks, and regulatory compliance. Whether working as staff adjusters or independent contractors, their expertise directly impacts customer satisfaction and company reputation. This role is both challenging and rewarding, offering opportunities for growth in a dynamic field that demands continuous learning and adaptability to industry changes and evolving customer needs.

1.2 Importance of a Comprehensive Study Guide

A comprehensive study guide is vital for success in the claims adjuster profession. It provides structured learning, covering essential insurance concepts, legal procedures, and practical application skills. By offering detailed explanations and practice questions, a study guide ensures mastery of key topics. It helps aspirants prepare for licensing exams, understand policy coverage, and develop effective claims settlement strategies. A well-organized guide also highlights state-specific requirements, ensuring compliance and readiness for real-world challenges. This resource is indispensable for both newcomers and experienced professionals seeking to enhance their expertise and stay updated on industry standards and best practices.

Key Concepts and Coverage in the Study Guide

This section covers fundamental insurance terms, types of policies, and detailed claims settlement procedures. It also includes state-specific requirements and practical skills for effective claim handling.

2.1 Insurance Terms and Definitions

Mastering insurance terminology is crucial for success. Terms like deductible, premium, and coverage limits are essential. Understanding claims-made vs. occurrence policies and floaters in inland marine coverage is vital. These definitions form the foundation of effective claim handling, ensuring adjusters can interpret policies accurately and make informed decisions. Resources like the NAIC glossary and IRMI provide detailed explanations, helping adjusters build a strong knowledge base. This section equips learners with the necessary vocabulary to navigate complex insurance scenarios confidently.

2.2 Types of Insurance Policies and Coverage

Understanding various insurance policies is critical for claims adjusters. Common types include property insurance, covering damage to buildings or assets, and liability insurance, addressing third-party injuries or damages. Auto insurance policies typically cover collisions, comprehensive damage, and bodily injury. Workers’ compensation insurance provides benefits for workplace injuries. Each policy type has specific coverage limits, exclusions, and conditions. Adjusters must analyze policy terms to determine applicable coverage and ensure fair claim settlements. Familiarity with these policies enables adjusters to navigate complex scenarios effectively, making accurate decisions that align with policyholder needs and insurer obligations.

2.3 Claims Settlement Process and Procedures

The claims settlement process involves several key steps, starting with the initial report of a claim. Adjusters must gather detailed information, assess damages, and verify policy coverage. Evidence collection, such as photos or witness statements, is crucial for accurate evaluations. Once liability and coverage are confirmed, adjusters negotiate settlements or issue payments. Effective communication with policyholders and stakeholders ensures transparency. Proper documentation and adherence to regulatory guidelines are essential throughout. This process requires strong analytical and interpersonal skills to ensure fair and timely resolutions. Mastery of these procedures is vital for adjusters to maintain trust and efficiency in claims handling.

Exam Preparation and Study Strategies

Utilize practice questions, video tutorials, and detailed lessons to master exam content. Track progress, focus on weak areas, and simulate real exams for optimal preparation and success.

3.1 Tips for Passing the Claims Adjuster Exam

To succeed, create a structured study schedule and thoroughly review insurance terms, policy types, and claims procedures. Practice with sample questions and simulated exams to build confidence. Focus on understanding key concepts like coverage limits, deductibles, and settlement processes. Utilize flashcards for quick term memorization and video tutorials for complex topics. Review state-specific requirements and legal aspects. Track progress to identify weak areas and allocate more study time accordingly. Stay calm during the exam, manage time effectively, and ensure all questions are answered. Leveraging free resources like Mometrix’s study guide and Kaplan’s tools can significantly enhance preparation. Consistent effort and strategic studying are essential for achieving success.

3.2 Utilizing Practice Questions and Simulated Exams

Engaging with practice questions and simulated exams is crucial for exam success. These tools help familiarize yourself with the exam format, timing, and content. Regularly tackling sample questions improves understanding of insurance concepts, policy coverage, and claims procedures. Simulated exams replicate real test conditions, allowing you to assess readiness and identify weak areas. Free resources like Mometrix’s practice exams and Kaplan’s study tools offer detailed feedback and hints. Flashcards and video tutorials further enhance preparation. Consistent practice builds confidence and ensures mastery of key topics, ultimately leading to a higher likelihood of passing the claims adjuster exam on the first attempt. Stay consistent and focused.

Free Claims Adjuster Study Materials

Access top sources for free study guides, eBooks, and practice exams to excel in your claims adjuster exam preparation without any cost.

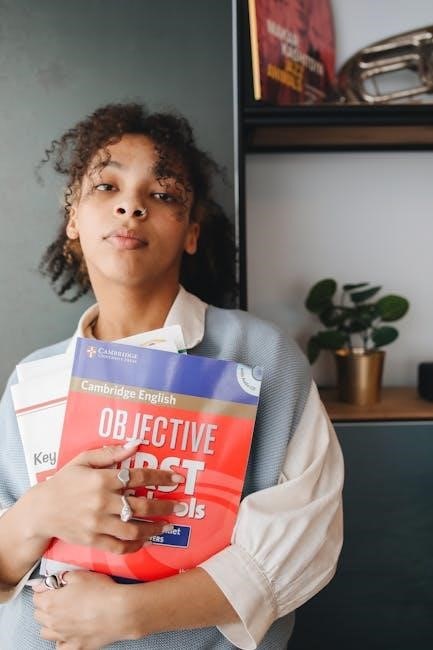

4.1 Top Sources for Free Study Guides and eBooks

Discover leading platforms offering free claims adjuster study guides and eBooks. Websites like Mometrix and NAIC provide comprehensive materials, including practice questions and detailed lessons. Additionally, IRM offers a glossary of insurance terms, while Kaplan provides sample study tools. These resources cover key concepts like policy types, claims processes, and state-specific requirements. Utilize downloadable PDF guides and flashcards to enhance your preparation. Free eBooks are also available, ensuring access to essential knowledge without financial barriers, making your journey to becoming a licensed adjuster more manageable and effective.

4.2 Accessing Free Practice Exams and Flashcards

Enhance your exam readiness with free practice exams and flashcards. Platforms like Mometrix and NAIC offer downloadable resources, including simulated exams and flashcards, to test your knowledge. Kaplan provides interactive study tools, while IRM offers glossaries and concept-based practice questions. Many websites allow you to track progress and identify weak areas. These tools are essential for mastering insurance terms, policy types, and claims procedures. Utilize these free resources to refine your skills and ensure a thorough understanding of the material before taking the actual exam, boosting your confidence and readiness for success.

State-Specific Study Guides

Discover state-specific guides, such as the Louisiana and New York study guides, offering tailored resources and PDF downloads to help you excel in your region’s exam requirements effectively.

5.1 Louisiana Claims Adjuster Study Guide

The Louisiana Claims Adjuster Study Guide is tailored to meet the state’s specific licensing requirements, offering detailed insights into local insurance laws and regulations. It covers key topics such as property damage assessment, liability claims, and auto insurance policies. The guide includes practice questions, case studies, and downloadable PDF resources to ensure comprehensive preparation. Additionally, it provides tips for navigating Louisiana’s unique insurance landscape and emphasizes ethical practices in claims handling. This resource is essential for aspirants seeking to excel in the Louisiana claims adjuster exam and build a successful career in the field.

5.2 New York Claims Adjuster Exam Study Guide

The New York Claims Adjuster Exam Study Guide is designed to help candidates master the state-specific requirements for licensing. It focuses on New York insurance laws, policy coverage, and claims procedures. The guide includes practice exams, flashcards, and detailed study lessons to ensure readiness. Key topics covered are workers’ compensation, personal auto insurance, and homeowners’ policies. Additionally, it offers video tutorials and progress-tracking tools to identify and improve weak areas. This resource is invaluable for aspirants aiming to pass the New York adjuster exam and thrive in the competitive insurance industry.

Mastering the claims adjuster study guide ensures success in the exam and builds a strong foundation for a rewarding career in insurance claims adjustment.

6.1 Final Tips for Success in Becoming a Claims Adjuster

To excel as a claims adjuster, utilize reputable study guides and practice exams to build confidence. Understand key insurance concepts, legal procedures, and practical skills. Track your progress to identify weak areas and improve. Stay updated on industry changes and continuously learn. Engage with flashcards and simulated exams to reinforce knowledge. Prioritize organization and time management during studies. Seek mentorship from experienced adjusters for insights. Finally, remain persistent and dedicated to achieve long-term success in this rewarding field.